FinTech Startup

Company Background

FinTech Startup specializes in developing an AI-powered financial management platform aimed at helping small-to-medium-sized businesses automate invoicing, expense tracking, and financial reporting. The platform has over 50,000 active users and processes over $1 billion in transactions annually.

The Problem

Before implementing Continuous Integration/Continuous Deployment (CI/CD) methodologies, Startup faced several issues:

-

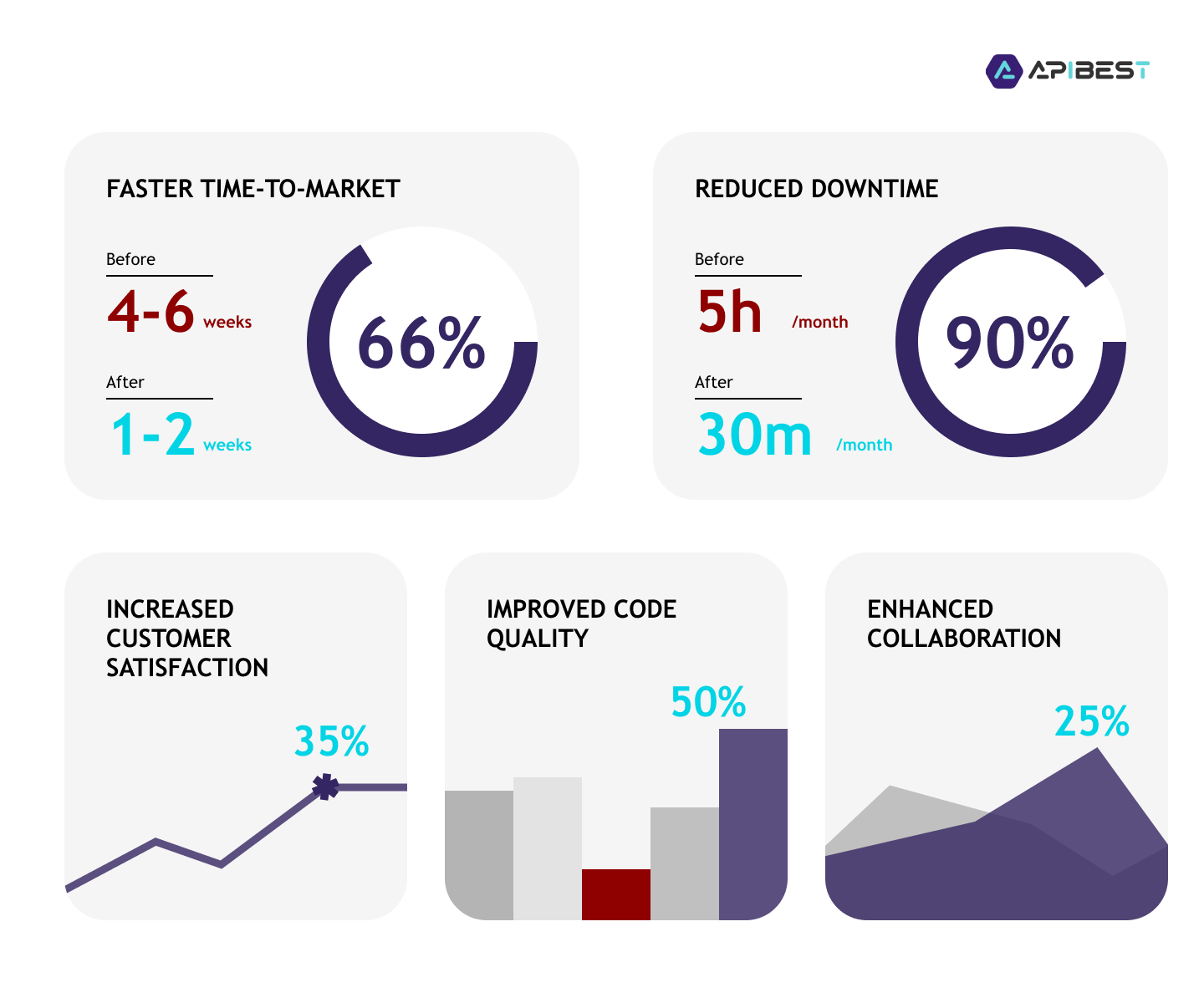

Slow time-to-market for new features and bug fixes: On average, it took the team 4-6 weeks to release a new feature

-

Inefficient manual testing and deployment processes: The team spent approximately 30% of their time on manual testing and deployment activities.

-

High risk of introducing breaking changes to the production environment: The platform experienced a 10% downtime rate due to breaking changes.

-

Frequent downtime and outages: Customers reported, on average, 5 hours of downtime per month.

The Solution

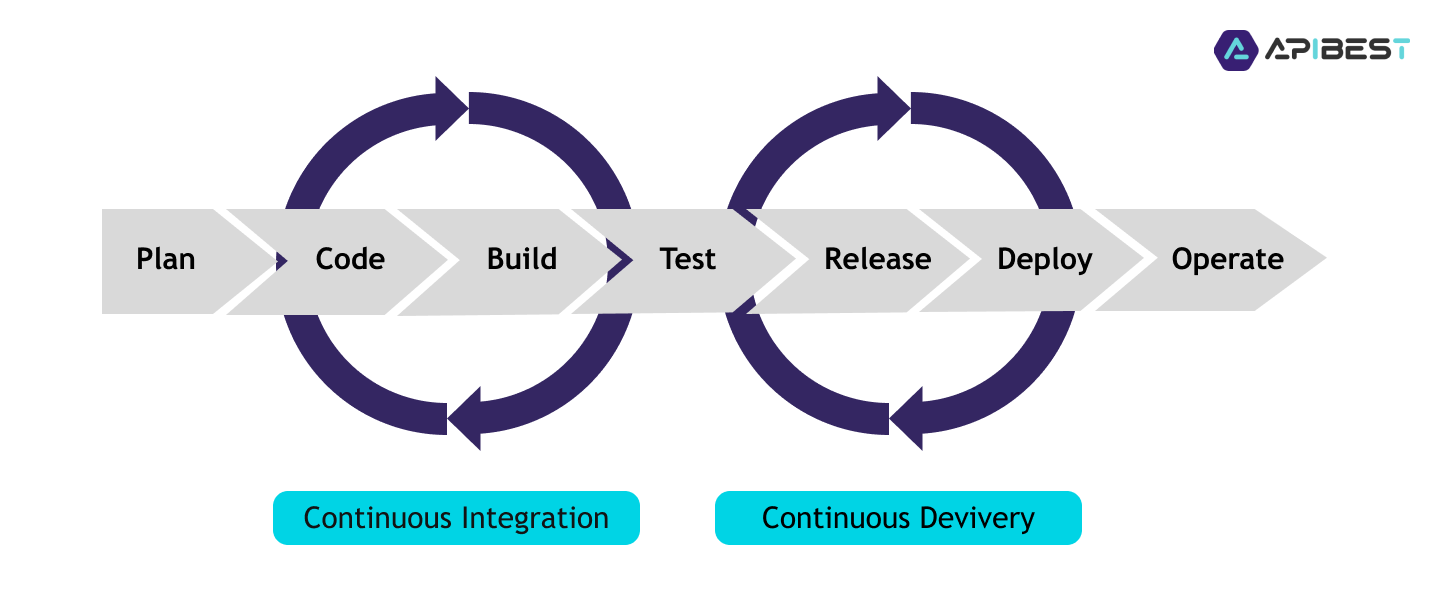

The startup implemented a robust CI/CD pipeline to address these issues and streamline their software development and deployment processes. The pipeline included:

-

Automated code testing: Every time a developer pushed new code to the repository, automated tests were run, reducing manual testing efforts by 80%.

-

Continuous Integration: The development team integrated their code into a shared repository multiple times a day, reducing integration issues by 70%.

-

Continuous Deployment: Once the code passed all tests and was approved, it was automatically deployed to the production environment, reducing deployment times from hours to minutes.

-

Monitoring and feedback: Tools were put in place to monitor application performance and collect customer feedback, enabling the team to quickly identify and address any issues.

The Result

By implementing CI/CD, FinTech Startup realized several key benefits:

In conclusion, implementing CI/CD allowed FinTech Innovators Inc. to transform its software development process and improve its product offering. The company's platform became more stable, reliable, and feature-rich, leading to a 20% increase in active users and a 15% increase in annual transaction volume.